Employee Stock Ownership Plan (ESOP)

Employee ownership is a big deal!

Receive annual contributions to your employee stock paid by Productive Living Systems. During your first full calendar year, you earn a year of vesting. Starting in the second year, you earn allocations and gradually earn the right to take the value with you when you leave employment with us.

Our Employee Stock Ownership Plan allows you to earn an ownership interest in our company in the form of shares or stock as long as you are employeed with us. Your shares are held in a trust in your individual account. The value of those shares changes annually based on the success of Productive Living Systems.

Most Americans find it difficult to save for the future, having little to nothing for retirement or future planning. At Productive Living Systems, we do it for you through contributions to your ESOP account. Even though you can't borrow from it or access it while you work for us, many employees have accumulated thousands of dollars in their ESOP after only 2-5 years — which is 100% EMPLOYER FUNDED!

Our success is your success.

In an employee-owned company, all employees share in the company's financial success, rather than only one owner receiving all of the benefit. More financial success for the company, means increased stock value and additional contributions to your ESOP account. There are controllable factors that help to improve the PLS financial performance, such as turning lights off, keeping up with routine maintenance, and avoiding over spending. The actions of all PLS employee-owners affect the stock value.

When and How You Get Paid

Following your separation from employment with us, you will be eligible to receive the distribution of your individual ESOP account balance in the following plan year. You will receive the vested percentage of your account. This percentage is determined by the number of years you have worked for PLS. You may receive your account distribution as a single lump-sum payment or in five equal installments by cash or rollover.

- Cash—You may elect to receive the value of your account in cash which will be subject to normal income taxes; if this distribution is made prior to attaining age 59 1/2, you will be subject to IRS penalties.

- Rollover—You may elect to rollover the value of your account into a similar investment account such as a traditional IRA or 401(k) account. There are no IRS penalties or taxes due at the time of rollover.

Once you are age 55 and participated in our ESOP for 10 years, you are eligible for diversification. This allows you to diversify up to 25% of your balance during the first five years. In the sixth year, you may elect to diversify up to 50% of your stock balance.

*Please consult your personal tax advisor to determine which option is best for you.

This is basic information on the Employee Stock Ownership Plan. When making decisions about your benefits, please see the Summary Description or the ESOP Plan Document for details. Questions, reach out to plsesop@plsmail.net.

Frequently Asked Questions

How is the price of PLS stock determined?

The stock price is determined by an independent valuation firm annually. The value is influenced by many controllable and uncontrollable factors, such as, PLS financial performance, projected growth, and economic outlook.

How do I know what the balance of my ESOP account is?

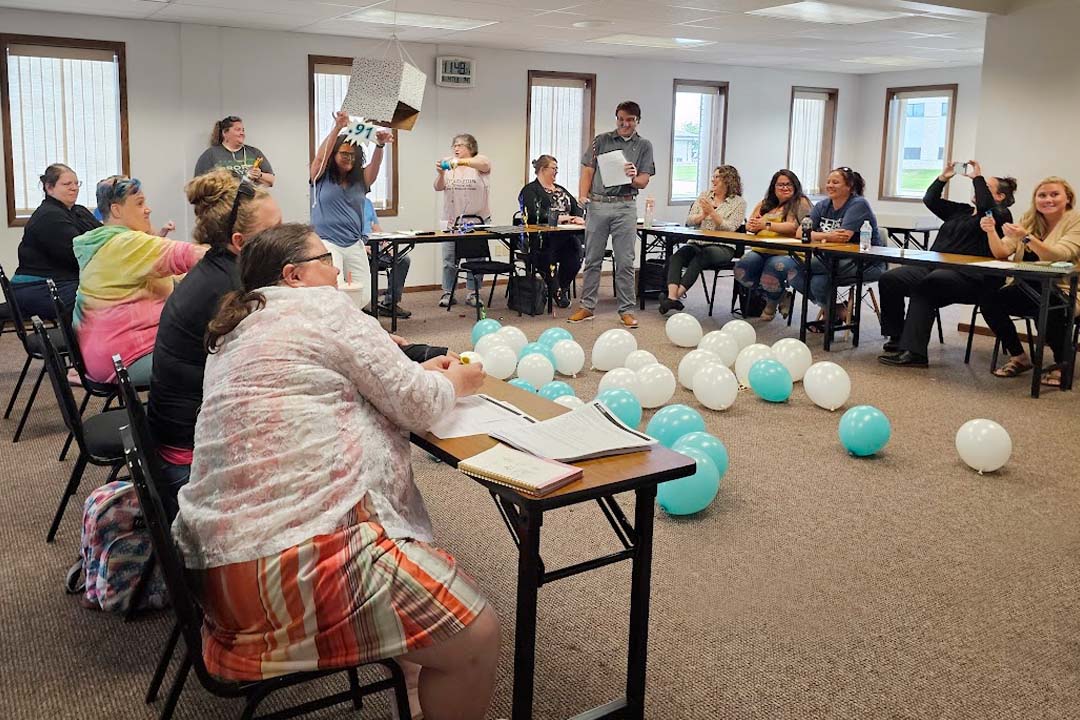

After the valuation process is complete, senior leadership will host a Share-Price Reveal event for staff, where the new share price and the factors that drove the change in value will be presented. Annual participation statements, showing your balance, will be mailed to your home following these events as well as updated in your online ESOP dashboard.

How is the PLS ESOP different from a 401(k) plan?

In an ESOP, the employee owner's account balance is made up of shares of PLS stock and the value fluctuates based on the financial success of PLS. It is also 100% employer funded. In a typical 401(k) plan, your account balance is made up of investments in many different companies, based on their financial success. It is also funded mostly by the employee.

What are the eligibility requirements to participate in the ESOP?

An Employee becomes a participant in the first plan entry date after the employee completes one year of employment, performs 1,000 hours of service in that year and is 18 years of age. Plan entry dates are July 1 and January 1.

How long does it take to become 100% vested?

After your second year (working at least 1000 hours) you are 20% vested in your account. You gain vesting percentage each year that you are with PLS, up to six years. After six years or more, you are 100% vested in your account. Your account is not done growing after that. Each year there will be more additions, and the stock value can grow over time.

- 0% Vested: before one year of employment

- 20% Vested: after two years of employment

- 40% Vested: after three years of employment

- 60% Vested: after four years of employment

- 80% Vested: after five years of employment

- 100% Vested: after six or more years of employment

What does it mean to be vested?

Being vested in a retirement plan is the process of the employee progressively earning the actual rights to their allocated shares through continued years of service. (The PLS vesting schedule is shown on this page.) For example, if you were to leave employment after four years, you would receive 60% of your ESOP account balance. If you remain employed for six or more years then and decide to leave, you would receive 100% of your account balance.